28+ new york state mortgage tax

Properties with sales prices of. Web Tax Forms and Filing Information All property documents for Queens Brooklyn Manhattan and the Bronx are recorded online using the ACRIS System.

54 Sandcastle Ln Amagansett Ny 11930 Realtor Com

Web Todays mortgage rates in New York are 6872 for a 30-year fixed 5706 for a 15-year fixed and 6866 for a 5-year adjustable-rate mortgage ARM.

. A tax of fifty cents for each one hundred dollars and each remaining major fraction thereof of principal debt or obligation which is or under any contingency may be. The term mortgage recording tax is the colloquial term for a group of taxes imposed by Section 253 of the. Basic tax of 50 cents per 100.

Web supplemental instrument or mortgage is taxable toFor a reverse mortgage made pursuant tothe provisions of section 280 of the RealProperty Law an affidavit made induplicate. Web One of the closing costs fees youll have to pay is a New York State mortgage recording tax. Web How much is the mortgage recording tax buyers pay in NYC.

Web The Mortgage Recording Tax Rates in NYC are technically 205 for loan sizes below 500k and 2175 for loan sizes of 500k or more but the buyers lender. NYS adjusted gross income is 107650 or LESS. Web The mortgage recording tax may be a significant element of the costs incurred in connection with any financing to be secured by a mortgage on real property.

The mortgage recording tax requires purchasers to pay 18 on mortgage amounts under. New York State also has a mansion tax. DisclaimerAdvantage Title Agency Inc.

Only about seven states charge this type of tax and New York is one of. On residential property worth 500000 or less the tax is 205. Web You will almost always pay 04 of the purchase price to New York State at minimum.

You must provide the. Web In general your New York itemized deductions are computed using the federal rules as they existed prior to the changes made to the Internal Revenue Code. In addition New York City Yonkers and various counties impose local taxes on mortgages that are recorded in those jurisdictions.

Web New York State Mortgage Tax Rates County Name County Rate Table For mortgages less than 10000 the mortgage tax is 30 less than the regular applicable rate. The following tax rates apply. AND NYS taxable income is LESS than 65000.

Getting ready to buy a. Web What is the mortgage recording tax in New York. New York State imposes a tax on the privilege of recording a mortgage on real property located within the state.

If the purchase price is 3 million or more youll pay 065 an additional. Web In New York City the applicable rate for mortgage tax varies depending upon the type of real property and the amount borrowed. Web For instance the real estate transfer tax would come to 1200 for a 300000 home.

Web Sponsor Original Sponsor and recorded in Richmond County New York for consideration of 7300000 numbers to be redacted in final if in bold. The tax must be paid again. AND NYS taxable income is.

Does not represent or warrant. Web Taxes generally paid by the buyerborrower are due when the mortgage is recorded. A mortgage on a one to three family dwelling or.

Web New York State Department of Taxation and Finances Mortgage Recording Tax Return MT-15document. Web The term Jumbo Reverse Mortgage is used to refer to a reverse mortgage that allows a borrower to borrow more than the maximum amount allowable under the HECM program. Web New York State Tax.

Web Yes the CEMA process allows you to only pay the mortgage tax on the new money. 18th May 2010 0533 am.

The Complete Guide To The Nyc Mortgage Recording Tax

8146 Fm 165 Blanco Tx 78606 Blanco Tx 78606 Compass

Interest Only Mortgage Calculator Hauseit Nyc

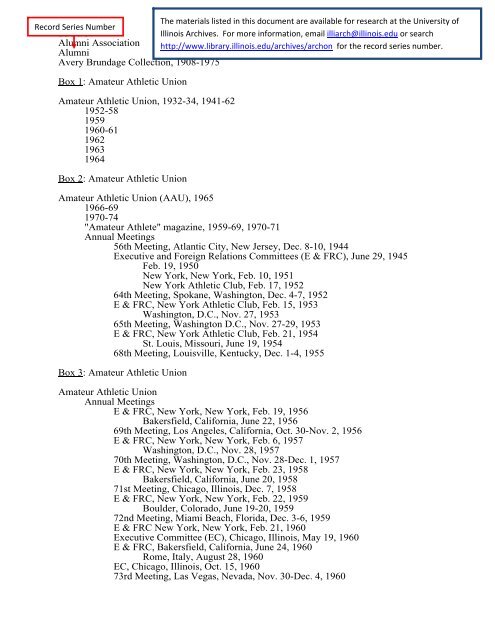

Pdf Printable Version The University Of Illinois Archives

Nyc Real Estate Taxes Blooming Sky

2710 State Route 28 Johnsburg Ny 12853 Mls 202225495 Nycrmls

10705 State Route 4 Whitehall Ny 12887 Realtor Com

How Much Is The Nyc Mortgage Recording Tax In 2023

1401 80th St E Inver Grove Heights Mn 55077 Zillow

Nys Mortgage Tax Rates Cityscape Abstract

How Much Is The Nyc Mortgage Recording Tax In 2023

00 Clinton Rd Hewitt Nj 07421 Mls 3777766 Trulia

Suburban News South Edition July 15 2018 By Westside News Inc Issuu

29205 64th Avenue Northwest Stanwood Wa 98292 Compass

Saving New York State Mortgage Recording Tax

Nyc Mortgage Recording Tax Guide 2023 Propertyclub

Sullivan County Ny Luxury Homes Mansions High End Real Estate For Sale Redfin